W2 payroll tax calculator

2020 Federal income tax withholding calculation. Use this tool to.

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Medicare 145 of an employees annual salary 1.

. Ad Payroll So Easy You Can Set It Up Run It Yourself. Then look at your last paychecks tax withholding amount eg. Federal Paycheck Calculator Calculate your take home pay after federal state local taxes.

250 minus 200 50. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. 1 Use Our W-2 Calculator To Fill Out Form.

Free 2022 Employee Payroll Deductions Calculator. 2 File Online Print - 100 Free. If you work for.

Get an accurate picture of the employees gross pay. Use this calculator to view the numbers side by side and compare your take home income. 1 Create Your IRS W-2 Form Online Free 2 E-file Print In Minutes - Try Free.

Time and attendance monitoring just got a whole lot easier. Free Unbiased Reviews Top Picks. Ad 1 Fill Out Fields Make an IRS W-2 2 Print File W-2 - Start For Free.

Ad Compare This Years Top 5 Free Payroll Software. Updated for 2022 tax year. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings.

For help with your withholding you may use the Tax Withholding Estimator. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. Also known as paycheck tax or payroll tax these taxes are taken from your.

Use this simplified payroll deductions calculator to help you determine your net paycheck. The standard FUTA tax rate is 6 so your. Customized for Small Biz Calculate Tax Print check W2 W3 940 941.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Federal New York taxes FICA and state payroll tax. Subtract 12900 for Married otherwise.

Could be decreased due to state unemployment. That result is the tax withholding amount you. Ad Compare This Years Top 5 Free Payroll Software.

Compare your income and tax situation when you work as a W2 employee vs 1099 contractor. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. The information you give your employer on Form W4.

Unemployment insurance FUTA 6 of an employees first 7000 in wages 2022 2. Plug in the amount of money youd like to take home. Ad No more forgotten entries inaccurate payroll or broken hearts.

IRS tax forms. Free Unbiased Reviews Top Picks. Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

Ad 1 Fill Out Fields Make an IRS W-2 2 Print File W-2 100 Free. 250 and subtract the refund adjust amount from that. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

Prepare your FICA taxes Medicare and Social Security monthly or semi-weekly depending on your. All Services Backed by Tax Guarantee. How It Works.

Federal Salary Paycheck Calculator. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information. Enter the payroll information into Incfiles easy Employer Payroll Tax Calculator.

Estimate your federal income tax withholding. You can use the Tax Withholding. See how your refund take-home pay or tax due are affected by withholding amount.

Calculate your total income taxes. Withholding schedules rules and rates.

It S Your Money But Cpas Are Not Telling You About It Because It S Complicated But We Ll Handle It For You In 2022 Payroll Taxes Tax Credits Business

With Stubcreator Com Reliable Pay Stubs Are Generated Instantly Which Are Available For Print At The Same Time All Thanks To Its Paycheck Salary Calculator

Pin On Excel Templates

Calculating Ratios Balance Sheet Template For Excel Excel Templates Balance Sheet Template Balance Sheet Credit Card Balance

You Need An Expert To Help You Get That Form 941 Amended To Get Loads Of Cash Back That Belongs To You In 2022 Payroll Taxes Business Marketing Strategy

Fillable Form W 2 Or Wage And Tax Statement Edit Sign Download In Pdf Pdfrun Tax Forms Internal Revenue Service Fillable Forms

Pin On Usa Tax Code Blog

Easy To Use Payroll Software For Small Businesses Ezpaycheck Payroll Software Payroll Taxes Payroll

Bank Statement Bank America Statement Template Bank Statement Bank Of America

Fillable Form W2 2015 Edit Sign Download In Pdf Pdfrun Irs Tax Forms Credit Card Services Tax Forms

Tax Withholding Calculator For Employers Online Taxes Irs Taxes Federal Income Tax

Hourly Wage Then Log Download Pay Stub Template Word Free With Regard To Pay Stub Template Word Document Cumed O Word Free Microsoft Word Templates Templates

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet Tax Forms Irs Forms Irs Tax Forms

What To Do If Your W 2 Or 1099 Is Stolen Tax Return Payroll Software Tax Preparation

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

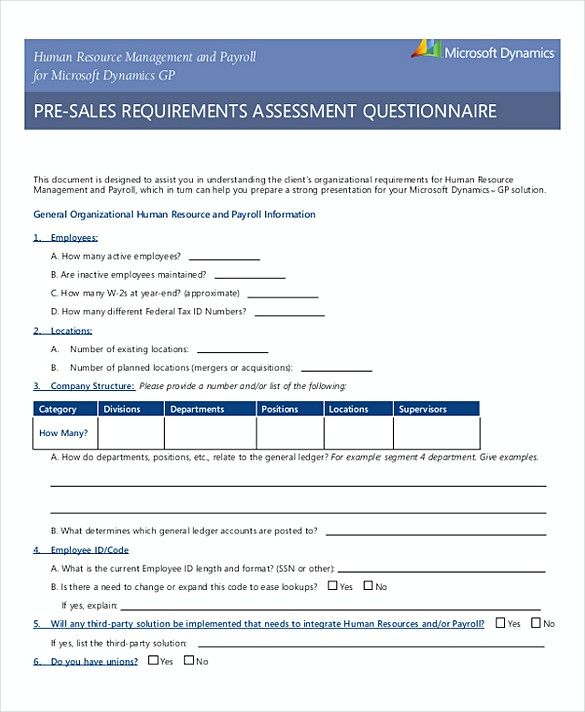

Hr Management Payroll What To Know About Payroll Invoice Template If You Are A Treasurer Of A Company You Have T Invoice Template Payroll Template Payroll

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time